BUSINESS TAX

& ACCOUNTING

YOUR ONLINE

BUSINESS ACCOUNTANT

ISO9001 Quality Certified

Public Accountant & Registered Tax Agent

On-Demand Low Cost Small Business Tax Solutions

Financial Report

Financial Report

Financial Report

Sole Trader

Tax Return

Tax Return

ELEGANT, FLEXIBLE, LOW FEE

ONLINE TAX RETURN

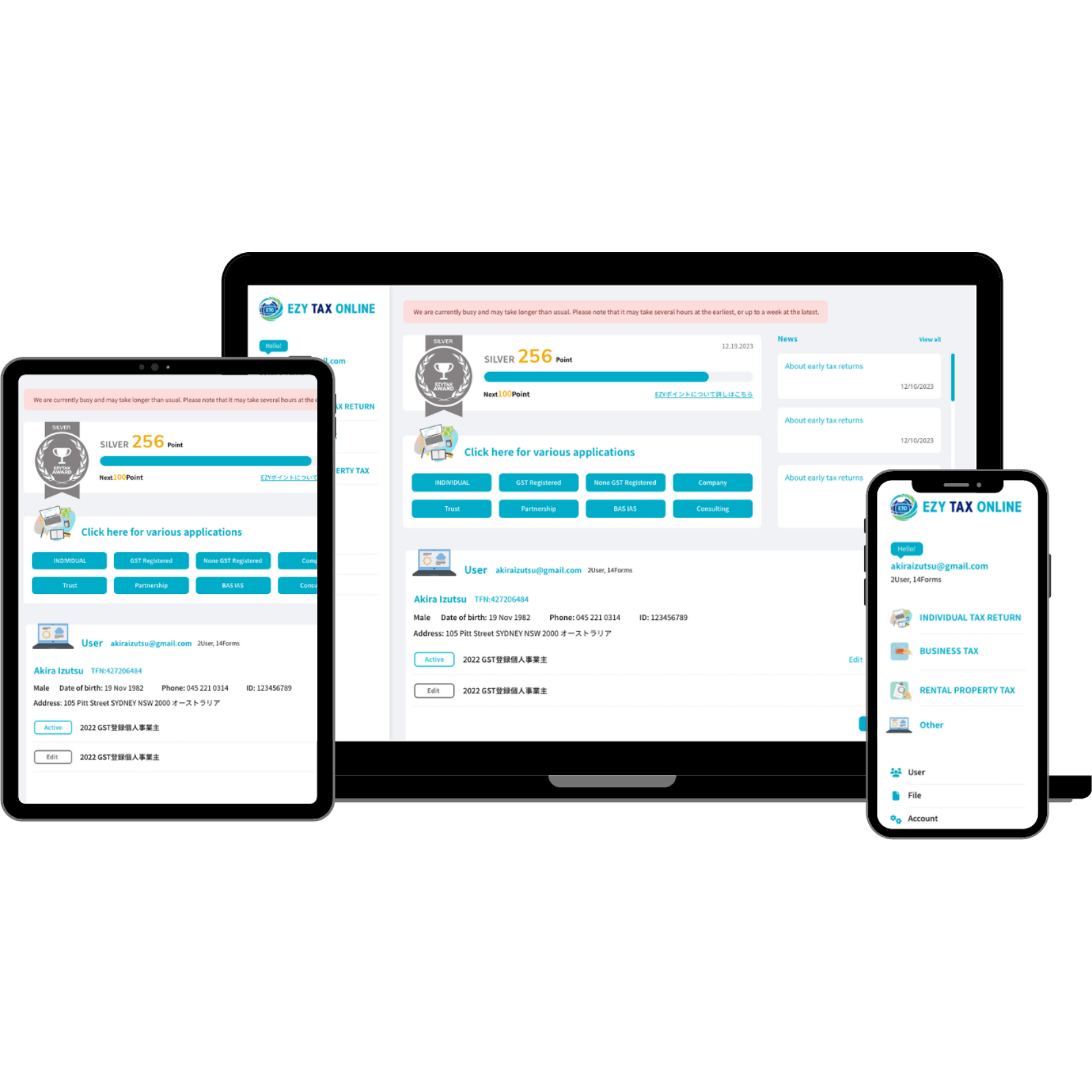

We are Ezy Tax Online, Small Business Tax Accountant

Online Accounting & Taxation Services

Are you looking for cheap business accounting and tax services by dedicated accountants?

Running a business is not easy. Let us take some of the pressure off – our team of small business accountant are experts in online business tax. Ezy Tax Online Biz is a professional but affordable accounting and tax solution to comply with annual business tax and accounting obligatiosn.

We can complete and lodge all of your annual business accounting and business tax return reporting and even offer other services as well. Our extensive expertise allows us to provide more complex business tax advice for your business if required.

What Clients Say

Why Clients Choose Us

Ezy Tax Online Biz

= All the Small Business Tax Solutions

Wide Range of Services of Ezy Tax online Biz to Suite Your Business Needs Build Your Own Combo

- Online Business Tax Return

- Registration & Cancellation

- Investment Property Tax Return

- Online BAS Lodgement

- Payroll Management

- New Business Setup

- ASIC Company Agent

- Cloud Bookkeeping Solution

- Xero Setup & Implementation

XERO ONLINE BUSINESS TAX RETURN

& FINANCIAL STATEMENT

Lodge your business tax return online. This is not copy and paste business tax return like other low cost providers. You do not need to provide Profit & Loss and Balance Sheet, it is our job. This is NOT an DIY automated service like others.

All of Australian entities must lodge tax returns every year if entities are active anytime during the financial year.

All years of business tax returns and financial statement are prepared for all of the small businesses in Australia. You can attach or email your bank reconciled accounting records or invite us to your cloud accounting software.

Some services prepare only a tax return however a proper business tax return cannot be prepared without a preparation of Profit & Loss and Balance sheet. As a public practice accounting firm as well as a registered tax agent, our service includes both of financial statement and business tax return.

This is not a DIY tax return service but prepared by qualified accountants.

Service Includes

- Business Tax Return

- Financial Statement (Bank Use)

- Routine Adjustments for the Best Tax Outcome

- Accounting Software Adjustment

- Online Advice and Technical Help

- Appointment as Tax agent and Public Accountant

- Carried out by Registered Tax Agents and Small Business Accountant

Conditions

- Xero Use

- Online Accounting Software Use (Currently not Available on This Fee)

- Excel from Imported Bank Statement (Currently not Available on This Fee)

- Bank Reconciled Accounting Records

COMPANY / TRUST TAX RETURN

& FINANCIAL STATEMENT

DORMANT

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- Only Company Maintenance Costs

LITE

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- No GST Registered

- No Payroll

STANDARD

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- GST Registered

- Payroll

- Max Business Turnover $500,000

PREMIUM

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- GST Registered

- Payroll

- Max Business Turnover $2M

SHARE & MANAGED FUND

OWNED CAR

DIVISION 7A

FINANCE

CAPITAL GAIN

PARTNERSHIP TAX RETURN

& FINANCIAL STATEMENT

DORMANT

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- Only Company Maintenance Costs

LITE

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- No GST Registered

- No Payroll

STANDARD

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- GST Registered

- Payroll

- Max Business Turnover $500,000

PREMIUM

- Income Tax Return

- Full Financial Report (Bank Use)

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- GST Registered

- Payroll

- Max Business Turnover $2M

SOLE TRADER

& UBER TAX RETURN

LITE

- Income Tax Return

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- No GST Registered

- No Payroll

STANDARD

- Income Tax Return

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- GST Registered

- Payroll

- Max Business Turnover $300,000

PREMIUM

- Income Tax Return

- Tax Agent Appointment

- Email Support

- Adjustment for the Best Tax Outcome

- Dedicated Accountant Tax Advice

- GST Registered

- Payroll

- Max Business Turnover $2M

Additional fee $100 applies for Desktop MYOB Users

OPTIONAL SERVICES

Reconciliation

GST Return

Annual Report

Advise

ONLINE

FAST BAS LODGMENT

also given by Tax Agent Lodgment

- DIY Lodgement

- From Accounting Software

- Preparation & Lodgement

- BAS Amendment

DIY LODGEMENT

ACCOUNTING SOFTWARE

PREPARATION & LODGEMENT

BAS Due Date

Monthly Lodgement Tax Agent Concessions

| Period | Original Due Date | Ezy Tax Online Biz | |

|---|---|---|---|

| Other than Dec | Other than Dec | 21th of the Following Month | 21th of the Following Month |

| Dec BAS | Dec | 21 Jan | 21 Feb |

Quarterly Lodgement Tax Agent Concessions

| Period | Original Due Date | Ezy Tax Online Biz | |

|---|---|---|---|

| Sep BAS | Jul – Sep | 28 Oct | 25 Nov |

| Dec BAS | Oct – Dec | 28 Feb | 28 Feb |

| Mar BAS | Jan – Mar | 28 Apr | 25 May |

| Jun BAS | Apr – Jun | 28 Jul | 25 Aug |

XERO CLOUD ACCOUNTING SOFTWARE

Ezy Tax Online is proudly Xero Gold Partner and Xero Certified Advisor. Xero is a leading cloud-based accounting software which allows you to run your business and access your accounts from work, home or anywhere. Xero helps you to reduce your work and maintain correct accounting records. Xero uniquely provides a single platform where small businesses can collaborate easily with Ezy Tax online. You invite us to your Xero as an advisor and share the data in real-time with Ezy Tax Online. You can access our online on-demand services anytime.

NEW BUSINESS SETUP

We advise the best suitable structure for your new business.

- Company ASIC Registration Package

- Trust Setup

- Partnership Setup

- Sole Trader ABN Registration

New Business Setup service

also includes

- Tax File Number Registration

- ABN Registrationn

- GST Registration

- PAYG Withholding Registration

REGISTRATION

& CANCELLATION

- ABN Registration

- GST Registration

- PAYG Withholding Registration

- Other ATO Registration

- Business Name Registration

CLOUD BOOKKEEPING

SOLUTION

- Access your accounts anywhere online

- Link your business bank accounts to automatically import and match transactions, to reduce data entry

- No upfront software or server costs

- Work with an accountant

- Xero Setup & Support

- MYOB Setup & Support

- Remote Bookkeeping Assist

PAYROLL MANAGEMENT

- Payroll Setup & Administration

- Payslip Preparation

- PAYG Payment Summary Preparation

- PAYG Annual Report

- Employer Superannuation Fund Setup

ASIC COMPANY

SECRETARIAL SERVICE

- Appointment of ASIC Agent

- ASIC Registration Change

- Share Structure Change

- Company Name Change

- ASIC Voluntary Deregistration